Investing Your Tech Salary 💰

🌀 A guide to making your tech salary work for you: Learn how to invest wisely, build wealth, and secure your financial future.

I’ve often found myself reflecting on ways to make the most of my salary.

Like many of you, I’ve experienced the thrill of landing a great job and the accompanying financial rewards - such as company stocks and a joining bonus.

And with those rewards I often had questions like — how do I make sure that my income not only sustains my current lifestyle but also sets me up for the future? I faced many initial hesitations and missteps before I discovered some strategies that have truly worked for me.

I’ll talk about maximizing employer benefits and building a diverse portfolio — all grounded in lessons I've learned along the way.

Let’s dive in! 👇

Really understand your income and expenses

The first step is understanding how much money you’re bringing in and where it’s going currently. This mainly involves two things:

💵 Track Your Spending: Use apps like Mint or YNAB (You Need A Budget) to categorize and track expenses.

💡 Create a Budget: Divide your income into key categories such as essentials (rent, food, utilities), savings, investments, and discretionary spending (fun, travel, hobbies).

A popular rule of thumb is the 50/30/20 rule:

📝 HQ Tip

Distinguish between essential grocery and food expenses and restaurant spending, which can quickly drain your budget.

Build an Emergency Fund

Before jumping into investments, ensure you have an emergency fund. This fund should cover 3-6 months of living expenses to help you weather unexpected events like job loss or medical emergencies.

🏦 Where to Keep It: Use a high-yield savings account to earn some interest while keeping your money accessible.

↪ How to Build It Up: Automate monthly transfers to your savings account.

📝 HQ Tip

High-yield savings accounts can help grow money faster than traditional savings accounts.

For example, if you deposit $50,000 into a traditional savings account at a bank with a 0.46% interest rate, you'll earn $230 in interest after one year.

If you deposit the same amount into a high-yield savings account with a 4.60% APY, you'll earn over $2,301.25 in interest after one year. Essentially, your money is making money until you end up needing it.

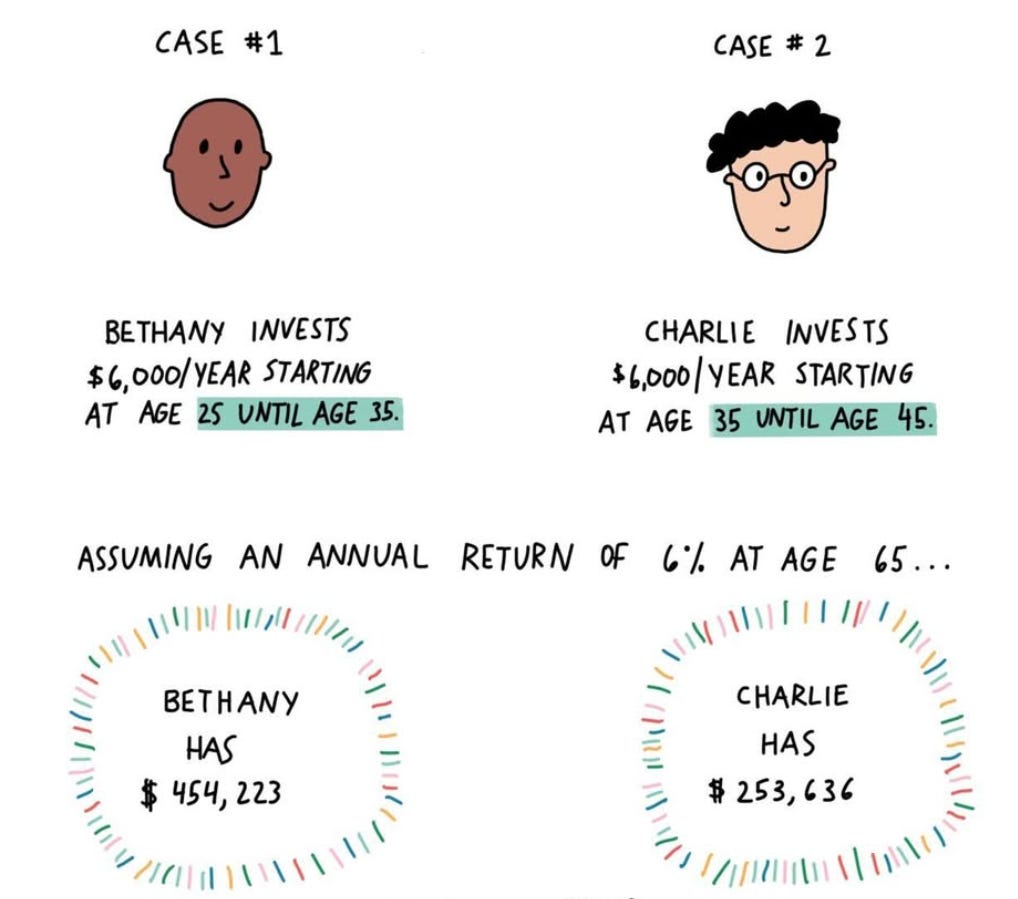

Start Investing Early

It’s time to really understand compound interest. Compound interest is when you earn interest on both the money you save and the interest that has already been added to it by your bank or your high yield savings account.

Over time, your money grows faster because you’re earning interest on a bigger and bigger amount. It’s like a snowball getting bigger as it rolls!

Bethany has more simply because her money was invested for longer, and every year her interest compounded, and her money grew. So, the sooner you start investing, the more you can benefit from compound interest.

💼 Maximize Employer Benefits

Pre Tax 401(k): Contribute at least enough to get your company’s match — it’s essentially free money. I’d suggest maxing out your pre tax 401k if you can, because this gives you a major tax break, and helps you save money for your retirement.

Not all companies offer 401(k)s so if your employer offers it, take advantage of it!

Employee Stock Purchase Plans (ESPP): If your company offers stock, it can be wise to hold onto that stock, but be mindful of how much of your net worth is tied up in one company.

🏦 Open a Roth IRA or Traditional IRA

Roth IRA: Contributions are taxed now, but withdrawals in retirement are tax-free.

Traditional IRA: Contributions are tax-deductible, but withdrawals in retirement are taxed.

Consider these options after you max out pre tax 401k.

📈 Invest in Index Funds

Index funds are essentially a preset basket of stocks. Look for ones tracking the S&P 500, which are low-cost, diversified well, and are funds with low expense ratios.

Like all stocks, major indexes will fluctuate. But over time indexes have made solid returns, such as the S&P 500’s long-term record of about 10 percent annually. That doesn’t mean index funds make money every year, but over long periods of time that’s been the average return.

📝 HQ Tips

Avoid day trading and focus on long-term growth rather than trying to time the market. While it can be profitable at times, it can also result in huge losses.

Review annually to re-balance your portfolio to maintain your desired asset allocation.

Set up automatic transfers to your investment accounts to ensure consistent investments.

Diversify Your Investments

Don’t put all your money in one basket. A year ago, I invested around 500 bucks in HTZ and lost almost half of it when the stock went down - see for yourself. Don’t be like me, be better 😌.

There are a lot of investment options:

1️⃣ Stocks: Focus on broad-market ETFs (exchange-traded funds) or index funds.

2️⃣ Bonds: Bonds are issued by governments and corporations when they want to raise money. You can purchase some if you want to decrease risk in your investment portfolio. They have a lower rate of return, but bonds tend to rise and fall less dramatically than stocks, which means their prices may fluctuate less.

3️⃣ Real Estate: Consider buying real estate, such as an investment property to rent out, or invest in your own home to build equity.

4️⃣ Side Projects: Invest in skills or projects that could lead to future income streams.

A Couple Other Things That Matter Long Term

💳 Pay Down High-Interest Debt

If you have any high-interest debt, such as credit card debt, prioritize paying it off before investing heavily. The interest rates on these debts often far exceed the returns you’ll make on investments, so it doesn’t make sense to keep these around for long.

Example: If your credit card interest rate is 18%, paying it off is equivalent to earning an 18% return on investment.

🏖️ Avoid Lifestyle Inflation

It is quite tempting to upgrade your lifestyle as your income grows, but that can return to haunt you later. Keeping your expenses relatively stable allows you to save and invest more long term. Let’s call this the “keeping up with the Joneses” trap 😅

🗂️ Don’t Forget Insurance

Financial investments can be wiped out by unexpected events if you’re not insured properly.

Health Insurance: Take advantage of employer plans and an HSA account if you have access to one through your employer plan.

Renters Insurance/Property Insurance: Protect your belongings.

Disability Insurance: Safeguard your income in case you can’t work due to an injury or illness.

📚 Invest in Yourself

Continuous learning can really get you to places and circles you want to be in. There’s really no substitute to consistent learning. Consider allocating part of your income to online courses, certifications, and networking events, like conferences or meetups.

Skills that enhance your earning potential are one of the best investments you can make.

Three Things You Can Start Tomorrow

Here are three simple actions you can implement right away:

1️⃣ Set Up Automatic Transfers to Savings

Open a high-yield savings account and schedule an automatic transfer of at least $200 per paycheck.

It’s a small step that builds your emergency fund sooner than you would think.

2️⃣ Enroll in Your 401(k) Plan

If your employer offers a 401(k) with match, sign up and contribute enough to get the full match.

This is probably the easiest money you’ll make and invest for your future. (Match means your employer will add the same amount that you add to your 401k, usually up to a max limit)

3️⃣ Download a Budgeting App

Spend 30 minutes setting up a budgeting app to get a clear picture of your income and expenses.

This will give you opportunities to save and invest more.

These small actions might not feel monumental today, but they carry a powerful truth: they’re the foundation for the strong financial future we will build together.

Start early 🕐,

stay consistent 📆,

and you’re all set 💯

That’s it for today! I hope this was helpful in understanding how to make your tech salary work for you. Let me know what you think about this post or if there is something particular you are struggling with by simply replying to this email or leaving a comment.

If you are finding this newsletter valuable, consider doing any of these:

1) Subscribe — Every week I write a short actionable post on something I have learnt in my career so far working at software companies in Silicon Valley. I cover things that I struggled with, which I have developed some mind maps for - how to navigate your tech job, network with people, and grow your net worth along the way. Read more about me and my journey which lead me to start writing Onboarded. Consider subscribing to get this content directly in your inbox:

2) Read with your friends — Help grow the onboarded team by sharing the article with a friend who may be in a similar boat. You can simply send them the email or send me a note with their email.

I wish you a great week!

Until next time,

Sonika