Demystifying Stock Grants 📈

🌀 A guide to understand the different parts of your compensation, especially equity, and how to maximize its value in your tech career

Starting your career in tech is exciting ✨

You were living on instant ramen and taco bell but you prepped your way to an interview, and then another, and then a couple more. Finally, your recruiter called and you got the offer! Now you are scrolling through your first job offer.

Amongst all the legal wording, you see some numbers pop up - base salary, signing bonus and stock compensation (also known as equity).

Consider this your cheat sheet to understanding all the different components of your compensation, especially stock compensation AKA the real money maker 💸, which can get a bit complex.

💵 Your Base Salary

Your base salary is the fixed, recurring amount of money you’ll earn annually for the work you do. It’s usually paid biweekly or bimonthly, or monthly.

It provides 3 benefits:

Stability: Base salary is guaranteed income, regardless of the company’s performance.

Budgeting: It helps you plan your monthly expenses, including rent, groceries, and savings.

Growth Potential: Increases over time through annual raises or promotions.

💰 Your Signing Bonus

A signing bonus is a one-time payment you receive when you accept a job offer. It’s typically used to sweeten the deal, especially if:

The company wants you to start quickly.

They need to compete with other offers you’ve received.

They’re compensating for lower initial stock or base salary.

How It Works:

Paid upfront or a little bit each month with your paycheck up to 1-2 years.

Sometimes split into multiple installments (e.g., half at signing, half after 6 months).

Usually taxable as regular income.

Key Considerations for Signing Bonuses:

⏎ Repayment Clauses:

Some bonuses require you to repay part or all of the amount if you leave the company before a set period (usually 12 months).

Read your offer letter carefully for these terms.

🗣️ Negotiation Opportunity:

If you’re negotiating salary and the company is firm on base pay, you can ask for a higher signing bonus instead.

📈 Your Stock Compensation

Your stock compensation isn't just a line item on your offer letter - it's potentially life-changing wealth that most of your friends working traditional jobs can only dream about. Stock compensation is how all of the tech billionaires made it to the Billion club. So understanding them will probably be your ticket to financial freedom.

Usually these are granted in one of 4 ways:

1. RSUs: Your Guaranteed Treasure Chest

Think: Free money that grows while you work

RSUs are simpler and more common, especially at established companies like Google or Amazon. They’re actual shares of stock granted to you after you meet certain conditions, usually time-based vesting.

No cost to you

Company shares which automatically become yours over time

Think of it like a savings account that pays you in company stock

How They Work:

📅 Grant Date: You’re promised shares of company stock (e.g., 1,000 RSUs).

⏳ Vesting Period: Shares are released to you gradually over time, generally starting after a "cliff" period (e.g., 25% after one year, then quarterly for three more years).

🧾 Taxable Event: When the shares become yours (AKA vest), their value is taxed as income.

2. Stock Options: The High-Risk, High-Reward Lottery

Think: A golden ticket to buy company shares at a discount

Stock options give you the right to buy company shares at a fixed price (called the strike price) after a certain period of time (vesting). They’re common at startups where companies want employees to share in future success.

Potential for massive gains if the company takes off, especially if you have joined early

More complex, but potentially more lucrative

How They Work:

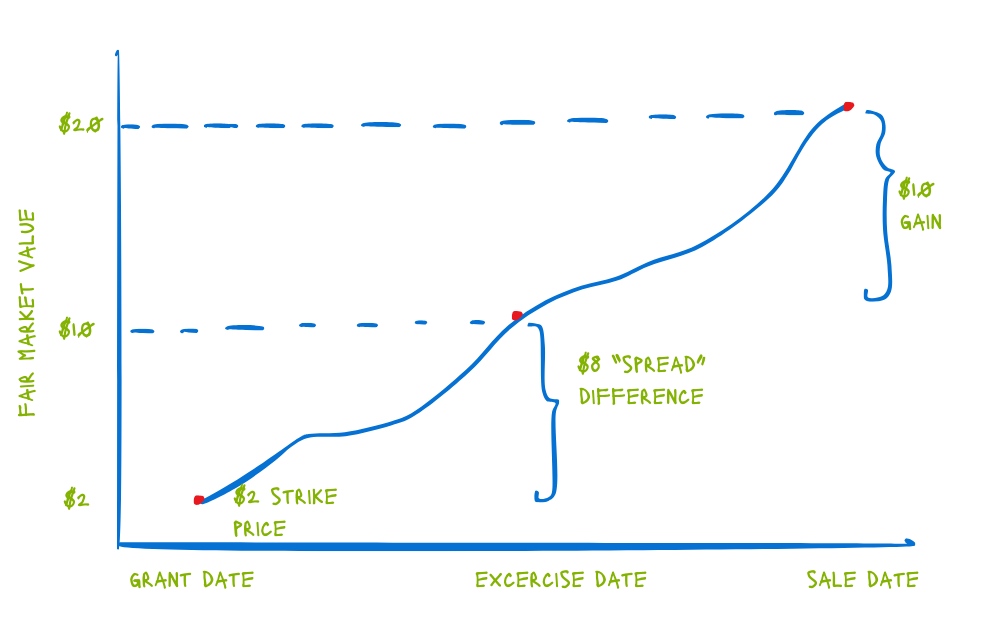

📅 Grant Date: The company gives you the option to buy shares at a strike price (e.g., $10/share).

⏳ Vesting Period: Over time, you earn the right to exercise (buy) your shares.

💵 Exercise and Sell:

You must pay the strike price to exercise options.

If the market price is higher than the strike price (e.g., $50/share), you can exercise and sell for a profit.

If the market price is lower than the strike price, your options may not be worth exercising.

2️⃣ Types: Incentive stock options (ISOs) and non-qualified stock options (NSOs).

ISOs are typically reserved for employees, while NSOs can be granted to employees, consultants, and directors.

ISOs offer certain tax advantages, as they are subject to specific tax treatment upon exercise and sale, while NSOs are subject to ordinary income tax rates upon exercise.

Read more about how each type is taxed here

⚠️ Risk: Options may expire worthless if the stock price stays below the strike price.

3. Profit Participation Units: The Startup Insider's Bonus

Think: Getting paid for the company's success without owning actual shares

Profit Participation Units (PPUs) are common in private companies and startups, particularly when equity (shares) isn’t directly issued. They function like phantom equity, letting you share in the company's success without owning actual shares.

Given in some early-stage private companies (example: OpenAI)

Rewards based on company performance

How They Work:

📅 Grant Date: You’re awarded units tied to the company’s valuation or profitability.

⏳ Vesting Period: Units vest over time, similar to RSUs or stock options.

💵 Payout: You receive cash or equivalent stock value based on the company’s performance (e.g., at an acquisition or IPO). Value depends on the company achieving a liquidity event (sale or IPO).

❌ No Ownership: You don’t own shares but still benefit from company growth.

4. Stock Refreshers: The Annual Motivation Boost

Think: Surprise bonus shares that keep you excited and loyal

Stock refreshers are additional stock grants provided periodically (usually annually) to keep employees incentivized and aligned with the company’s success. They’re common at larger companies.

Periodic additional stock grants, could be stock options or RSUs similar to your initial grant from the company

Keeps top talent motivated - it’s your company's way of saying "please stay", especially as initial stock grants vest and your compensation drops after the last time your shares vest (usually year 4 in most tech companies)

How They Work:

📅 Timing: Typically granted at performance reviews or anniversaries.

⏳ Vesting: Follows a new vesting schedule, separate from your initial stock grant.

Stock compensation is your potential passport from "just getting by" to "financial flexibility" but each type comes with its unique terms and risks.

Take time to understand your grant, and don’t hesitate to consult financial advisors or mentors for guidance. By making informed decisions, you can maximize your benefits and set yourself up for financial success 📈

Action Items

To make the most of your equity:

1️⃣ Understand Your Grant

Read your offer letter or equity grant agreement.

Know the type of equity and the vesting schedule.

2️⃣ Decide What to Do When Shares Vest

Hold: Keep the shares if you believe in the company’s growth.

Sell: Diversify to avoid over-reliance on one company’s stock.

3️⃣ Manage Taxes

Set aside cash for taxes if your company doesn’t withhold enough.

That’s it for today! I hope this was a helpful guide to understand the different parts of your compensation. Let me know what you think about this post or if you have something particular you are struggling with by simply replying to this email or leaving a comment.

If you are finding this newsletter valuable, consider doing any of these:

1) Subscribe — Every week I write a short actionable post on something I have learnt in my career so far working at software companies in Silicon Valley. I cover things that I struggled with, which I have developed some mind maps for - how to take charge of your career, network with people, and grow your net worth along the way. Read more about me and my journey which lead me to start writing Onboarded. Consider subscribing to get this content directly in your inbox:

2) Read with your friends — Help grow the onboarded team by sharing the article with a friend who may be in a similar boat. You can simply send them the email or send me a note with their email.

I wish you a great week!

Until next time,

Sonika